Monthly Financial Reports

To help PI’s with the management of their funds, OES Fund Managers provide monthly financial reports depicting the current financial status of an award. Reports are usually e-mailed by the 25th of the following month.

The financial information contained in these reports are derived from the financial accounting system (UCLA general ledger). In addition to costs that are posted to the general ledger, the financial reports include payroll and non-payroll expense projections (any recurring monthly expenses such as TIF, DLAM charges, insurance, telephone charges, etc.) for the budget period. Any further projections (expenses such as future travel, subject disbursements, scanning encumbrances, etc.) can be manually added upon request. A financial report will be sent to the PIs regardless of the amount of expenditure activity during the reporting period.

Financial Reports Explained

A financial report is an excel file consisting of several worksheets, each providing financial information for the project.

SUMMARY BY SUB tab

Fund Summary: FAU, Fund Name, PI Name, Project Period, Recharge ID, F&A Rate and the report run date.

Sub Categories: Used to organize expenses into separate categories.

Closed Ledger:

- Appropriations – Awarded amount as of the latest ledger close date. This column can also be referred to as the budget. If funds have been transferred to other departments/collaborators, or if your award has a multi-campus agreement, the appropriated amount will be reduced by those amounts. The appropriation should be distributed across the subs, according to your budget. If your appropriation column shows all funds in sub 08, please reach out to your fund manager with the approved budget and ask that the funds be appropriated accordingly.

- Expenditures – Expenses incurred as of the latest ledger close date, broken down by sub category.

Open Ledger:

- Appropriations – Any changes made to the budget after the latest ledger close date. If your appropriation column shows all funds in sub 08, please reach out to your fund manager with the approved budget and ask that the funds be appropriated accordingly.

- Expenditures – Expenses incurred after the latest ledger close date, broken down by sub category.

- Encumbrances/Memo Liens – Any open purchase orders/subawards, which represent funds committed toward a future payment on any order that has been placed using BruinBuy.

Future Expense Projections: Any projected payroll or non-payroll expenses up to the budget end date or a future date requested by the PI. Payroll related expenses hit sub 00 or 02 (academic or non-academic salaries), 03 (TIF or GAEL), and 06 (benefits). This information is pulled from UCPath.

Adjustments Inputted by Fund Manager: Any other upcoming expenses that you are aware of can be provided to the fund manager, who can manually add the projection for these expenses to the report.

Final Projected Fund Status: Total balance including payroll and non-payroll projections as well as adjustments inputted by the fund manager.

Overhead Adjustment:

- Direct – The actual direct cost total, based on the F&A Rate

- Indirect – The actual indirect cost total, based on the F&A Rate

- 9H TOF Adjustment Needed – The amount that needs to be transferred via TOF to correctly allocate funds between the direct and indirect categories

OPEN tab

Refer to the OPEN tab to view details on the appropriations (column 3), expenses (column 4), and open encumbrances (column 5) incurred after the latest ledger close date.

CLOSED tab

Refer to the CLOSED tab to view details on the appropriations (column 1) and expenses (column 2) incurred as of the latest ledger close date, as reflected in the SUMMARY BY SUB tab.

COMMITTED tab

This tab reflects all non-payroll expenses by sub-categories from the closed ledger for the month that is being reported.

ADDITIONAL ADJUSTMENTS tab

This tab reflects non-payroll expenses manually projected on the report per request from the admin/PI.

UNALLOWABLE & WARNING OBJECT CODE tab

Reflects the expenses that have unallowable or warning object codes. On a quarterly basis, this tab will be provided and needs to be reconciled.

PERSONNEL tab

Reflects the academic and staff payroll projections (blue box). Fund Managers may also manually add payroll projections for any pending adjustments (orange box). TIF and GAEL projections can also be added, if applicable (red box).

CURRENT PAYROLL MONTH EARNING tab

Reflects payroll expenses that posted to most recently closed ledger, including retro payroll adjustments.

What is a Distribution Change Request?

A distribution change request changes the fund(s) an employee is paid from, the amount of effort an employee is charged to the fund(s), or both.

These changes involve two sets of forms: one set for academic personnel, and another set for staff, GSRs, and Post docs.

Keep in mind that distribution change requests for academic personnel are only allowable for future months. Retroactive distribution changes—that is, changes to past months—are only allowed in cases of late award setup or a late transfer of funds (TOF) from the home PI’s account.

For staff, GSRs, and postdocs, retroactive distribution changes should only be used to correct payroll expenses charged to an incorrect funding source and should not be used as a tool for managing funds.

Academic Personnel

Non-Compensation Plan Members

1) Fill out a Non-Comp form.* The full name of the form is “Non-Compensation Plan Faculty/Other Academic Appointees Salary/Funding Adjustment Form.”

2) Request the employee’s current fiscal year distribution from the Semel Faculty DCR inbox at FacultyDCR@mednet.ucla.edu. The distribution will come as an Excel spreadsheet.

3) Copy the original distribution and paste it right below the original, so that two distributions appear on the same spreadsheet. Label the top one “Current” and the bottom one “New” and make the requested changes to the “New” distribution. Be sure to highlight any changes you make.

4) If the changes are retroactive, fill out a Cost Transfer Justification form. For further information about how to fill out a Cost Transfer Justification form, see the Cost Transfer Justification section.

5) Send all items (Non-Comp form, distribution, and Cost Transfer Justification form, if applicable) to FacultyDCR@mednet.ucla.edu.

6) Unita will route the documents to the appropriate fund managers for approval. After all the documents are approved, she will submit the documents to the Academic Personnel office for processing. Once processed, you’ll see the changes to the employee’s effort reflected on your financial reports.

*Non-Comp Forms are also used for new appointments, changing percentage of time worked, and fund rollovers.

Compensation Plan Members

Changes to Contract and Grant Funds Only

This is the same process as for Non-Compensation Plan Members, except you’ll fill out a contract and grant change request (CGCR) instead:

1) Fill out a CGCR form.

2) Request the employee’s current fiscal year distribution from the Semel Faculty DCR inbox at FacultyDCR@mednet.ucla.edu. The distribution will come as an Excel spreadsheet.

3) Copy the original distribution and paste it right below the original, so that two distributions appear on the same spreadsheet. Label the top one “Current” and the bottom one “New” and make the requested changes to the “New” distribution. Be sure to highlight any changes you make.

4) If the changes are retroactive, fill out a Cost Transfer Justification form. For further information about how to fill out a Cost Transfer Justification form, see the Cost Transfer Justification section.

5) Send all items (CGCR, distribution, and Cost Transfer Justification form, if applicable) to FacultyDCR@mednet.ucla.edu.

6) Unita will route the documents to the appropriate fund managers for approval. After all the documents are approved, she will submit the documents to the Academic Personnel office for processing. Once processed, you’ll see the changes to the employee’s effort reflected on your financial reports.

Changes to Finance Funds (either finance funds only OR a mix of finance funds and contract and grant funds)

1) Submit your request via the online distribution change request (DCR) system. The online DCR system allows you to download the faculty member’s current fiscal year distribution.

2) Copy the original distribution and paste it right below the original, so that two distributions appear on the same spreadsheet. Label the top one “Current” and the bottom one “New” and make the requested changes to the “New” distribution. Be sure to highlight any changes you make.

3) If the changes are retroactive, fill out a Cost Transfer Justification form (link to forms page). For further information about how to fill out a Cost Transfer Justification form, see the Cost Transfer Justification section.

4) Upload all items (distribution, salary savings letter, and Cost Transfer Justification form, if applicable).

5) Unita Morris will send you a completed DCR form for review and PI’s signature.

6) Obtain appropriate signatures and send back to Unita.

7) The DCR will be routed to the appropriate fund manager(s) for approval.

8) Once approved, Academic Personnel will process the changes. When processed, you’ll see the changes to the employee’s effort reflected on your financial reports.

Note: Due to UCPath conversion errors and delays in processing corrections, retro transfers will be allowed this fiscal year (18-19) if they are due to these issues. Also note that the DCR process is currently suspended until 2019-20 FCW completion. If you have any questions regarding to this suspension, please contact Unita Morris at x52522.

Staff, GSRs, and Postdocs

1) Fill out a Staff DCR form. The full name of the form is “Staff/Postdoc/GSR Distribution Change Request.”

2) If the changes are retroactive, fill out a Cost Transfer Justification form. For further information about how to fill out a Cost Transfer Justification form, see the Cost Transfer section.

3) Email completed Staff DCR and Cost Transfer Justification form (if applicable) to StaffDCR@mednet.ucla.edu.

a. Attach only one form per e-mail to facilitate tracking

b. In the subject line, include the employee name, effective date, and the office that will process. If only finance-managed funds are involved, the subject line should include “Finance”. If only C&G or C&G and finance-managed funds are involved, the subject line should include “OES”.

e.g., Joe Bruin – 12-1-18 – OES

4) The staff DCR will be routed to the appropriate fund manager(s) for approval.

5) The approved transaction will be entered into UCPath. Once the transaction is processed, the fund manager will forward a confirmation e-mail with a screenshot of the transaction to the administrator. If you do not receive confirmation within 5 business days, please follow up to ensure that your request is being processed.

Notes:

- Fund changes that accompany other actions (such as hiring, termination, FTE changes, etc.) must be submitted to HR via a PAR (Personnel Action Request).

- If the Staff Distribution Change Request form has typos, the fund manager will work with the administrator to correct and will proceed with entering the transaction once errors are resolved.

- If there are significant errors (i.e., problems with funding), the fund manager will route the request back to the administrator and the process will start over at step 1 above.

Fund Rollovers

Fund Rollovers are a special kind of distribution change request used when a project receives a different fund number every year. If you wish to keep employees on the new fund number at the same effort levels, a fund rollover form is the fastest way to do this. Fund rollover forms (with the exception of the form used for non-comp plan members) do not require approval signatures from the PI or the administrator.

Keep in mind that fund rollovers must be filled out at least 2 weeks in advance. If the changes are retroactive (e.g., due to late award setup or a late TOF from the home PI’s account), the usual paperwork must be used instead (CGCR, DCR, or Staff DCR).

Academic Personnel

Non-Compensation Plan Members

Fill out a Non-Comp form.

1) Email completed form to your fund manager.

2) Your fund manager will upload the form to the Academic Tracking system for processing by Academic Personnel. Once processed, you’ll see the changes to the employee’s effort reflected on your financial reports.

Compensation Plan Members

1) Fill out the Fund Rollover form for Academic Salaries.

2) Email completed form to your fund manager.

3) Your fund manager will upload the form to the Academic Tracking system for processing by Academic Personnel. Once processed, you’ll see the changes to the employee’s effort reflected on your financial reports.

Staff, GSRs, and Post docs

1) Fill out the Fund Rollover form for Staff, GSR, and Postdoc Salaries.

2) Email completed form to staffdcr@mednet.ucla.edu

3) Once the transaction is processed, your fund manager will forward a confirmation e-mail with a screenshot of the transaction to the administrator.

BruinBuy

BruinBuy is a web-based purchasing system that allows the user to purchase items from existing suppliers or new vendors. It is also the method used for processing reimbursements to UCLA staff for expenses incurred as part of performing job duties.

Before you can access BruinBuy, you must have an OASIS Logon ID and active password to complete the introductory course. Your Departmental Security Administrator (DSA) must submit a System Access Request (SAR) form to IT Services at least two weeks prior to training. Upon approval, you must complete IT Services’ Online Security training class as well as the in-person verification. In addition, participants must have an active employee email address established in the Campus Directory, and DACSS access with function-AP730, as granted by their DSA. The next step is to take the BruinBuy PAC Preparer training course.

Once you obtain BruinBuy access, additional training materials are located on BruinBuy.

When submitting invoices for processing, please submit electronically via the following link: Accounts Payable Invoice Submission Page.

Accounts Payable has set a standard for processing items within 10 business days of receipt. To see current processing times, please visit the following site: http://ap.finance.ucla.edu/service.htm

Hold and Incomplete (H&I)

Invoices listed as Hold (H) & and Incomplete (I) go unpaid due to a number of reasons. Once an invoice has been placed on H or I status, you must identify the reason for the processing delay. Funds that are on the H&I list are encumbered and are not released until the PO has been resolved or the PO has been zeroized entirely. It is very important that H&I invoices are resolved in a timely manner to maintain strong relationships with UCLA vendors.

Invoices on H status

H status refers to invoices that have been authorized for payment by Accounts Payable, but are unpaid for one of two reasons:

1) The department has set a receiving lock which prevents funds from being released on an order until the department manually enters into the system the items that were received in a satisfactory state (the receiving process). Once the department documents receiving, the funds are released automatically, and the invoice is paid. Accounts Payable (AP) does not need to be contacted to release the payment.

2) An invoice may also be placed on H status applies with an Electronic Data Interface (EDI) invoice for such vendors as OfficeMax and Fisher. H status is automatic when one of the following two scenarios occurs:

- An invoice is created for a greater quantity than listed on the purchase order (PO). The system will automatically generate a mismatch queue with the greater quantity and place it on H status.

- Two invoices are created on the same date, for the same PO, for the same item(s) and the PO only has enough quantity of item(s) to pay one invoice. The system will automatically process one of the invoices for payment and place it on P status (pending). The second invoice will also be processed, but it will be placed on H status.

Invoices on I (Incomplete) Status

I status refers to invoices that cannot be authorized for payment for various reasons, including the following:

- The PO is closed

- The PO has not been posted

- The billing on the invoice does not match the billing on the PO

- The quantity or price on the invoice cannot be matched with the PO’s quantity or price

- Only partial or insufficient documents were submitted for payment (such as missing pages or photocopies)

Procurement Card Orders (Pcard)

The Pcard is a Visa card that simplifies the purchasing of LVO goods and services where the vendor does not accept POs. The PCard does not replace the regular procurement method via Bruinbuy.

Pcard Application Requirements

- Be a full-time employee (no casuals, no students)

- Have BruinBuy access with a demonstrated 6-month period of responsible purchasing (i.e. 6 months and no unresolved H&I).

- Have a supervisor with a higher administrative title (i.e., not a PI). If this is not possible, submit a request for the Pcard manager to serve as the Pcard supervisor

- Receive approval from the OES and Semel Finance Offices

Pcard Application Review

Semel takes the following into account:

- The default FAU has sufficient funding so as to not create an overdraft.

- The purchasing limit is appropriate for the Center/Division requesting the Pcard.

- The applicant agrees to send a statement report to Pcard Manager/Pcard Supervisor

- The applicant’s Center/Division does not already have a designated Pcard holder

3 Strike Policy

Semel will take the following actions if a Pcard holder deviates from policy:

- First strike: Semel will require Pcard holders to complete refresher training to maintain Pcard privileges.

- Second strike: Verbal/written warning to PI of center/division.

- Third strike: Pcard privileges revoked.

*Note: Based on severity of PCard misuse, Semel maintains the right to revoke PCard privileges at any time.

Process for Requesting a Pcard

Step 1: Read and sign the Pcard policy

Step 2: Complete the DocuSign: Pcard Application

- Applicant: This is the individual who will be the cardholder

- Supervisor of Applicant: This individual will be reviewing the cardholder’s transactions and must be in a higher position than the applicant. If none, please enter Gladys Carrera

- Dean/CFO/CAO: This is the department’s final approver; Alexis Sexton

Step 3: Once the application has been approved the Pcard office will sign up card holder for training.

Step 4: Begin processing orders once Pcard is received through US mail.

Payments to Subawards

If your project includes a collaboration with other institutions, you will need to issue a subaward to that institution (see subaward setup in award setup section). Once the subaward has been posted to your fund, the sub will be able to submit invoices for work completed to the PI. If the PI approves, s/he should sign the invoice, along with the subaward invoice certification form (link to form). Both forms should be e-mailed to your fund manager, who will then do receiving in BruinBuy. The hard copy of the signed invoice should be forwarded to Accounts Payable, who will release payment to the subawardee.

To electronically submit an invoice to Accounts Payable directly, please use the Accounts Payable Invoice Submission Page.

Invoices typically take about 2-4 weeks to be processed. If you have an invoice outstanding for more than 30 days, you can fax it to AP at (310) 794-8020 and mark it “Rush Payment – 30 days past due”

Computer-Related

For computer-related purchases that will be used across multiple projects, list all applicable FAUs on the IT Quote Proposal form (note: link to form) to allocate the cost between all projects the items will be used for. If the purchase will be used solely for one project, this will require strong justification.

You will need a strong business justification to make computer-related purchases at the end of a project period (last 90 days). All charges to a project, particularly in the final months of the project period, must be necessary to completing project aims. Purchases may not be made to spend down an unobligated balance remaining at the end of the project.

90/30 Days Prior to Project End

90 days prior to project end: you need a strong business reason to make computer-related and equipment purchases.

30 days prior to project end: you need a strong business reason to make supply purchases.

All charges to a project, particularly in the final months of the project period, must be necessary. Purchases may not be made to spend down an unobligated balance remaining at the end of the project.

Travel Express

Travel Express is UCLA’s online reimbursement system for business travel and entertainment expenses.

For more information about how to use the system, enroll in the online Express Training course. Note that this training is not mandatory to gain access to the Express system, but may help you familiarize yourself with the system.

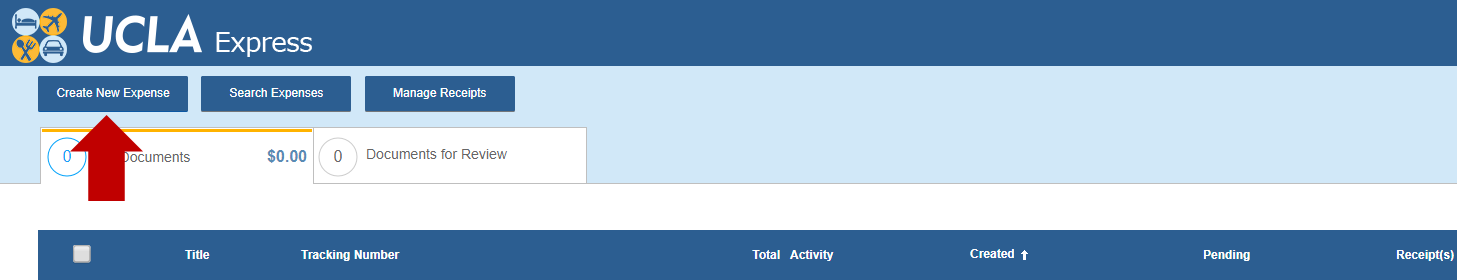

To fill out a Travel Reimbursement Request, visit the Travel Express website and click “Create New Expense”.

Be sure to include information in the description about how the travel is applicable to the project(s) it is being charged to and review the following travel reimbursement policies:

What is a Cost Transfer?

A cost transfer is an after-the-fact reallocation of costs from one fund to another. There are two types of cost transfers: those that transfer payroll costs (direct retros) and those that transfer non-payroll costs (NPEARs). Sponsors scrutinize cost transfers closely for indications of cost misallocation. Cost transfers should not be a tool for managing sponsored awards. Be sure to review your monthly reports regularly. If an expense has been charged to a funding source in error, complete a Cost Transfer Justification Form (link to forms page) and send a copy signed by the PI to your fund manager so that they may move the expense to the correct funding source. In cases where personnel have been charged to a funding source in error, you’ll also need to submit a distribution change request form.

Expense transfers require strong business justifications, e.g. late award set up or a late TOF from the home PI’s account.

Cost transfers of expenses older than 120 days are even more greatly scrutinized and require Extramural Fund Management (EFM) approval. Be sure to include a strong justification of why the transfer is being made in an untimely manner. If the justification is not sufficiently strong, your fund manager or EFM will ask for further clarification.

For further details, refer to the Cost Transfer Justification Form section.

Direct Retros

Direct retros transfer payroll costs from one FAU to another. When you submit a retroactive distribution change request, the office that processes the request will process the direct retros (e.g., Academic Personnel Office processes them for academic personnel; fund managers process them for staff, post docs, and GSRs).

Once processed, you will see the changes reflected on your financial reports.

Before the UCPath transition, payroll cost transfers were called UPAYs or PETs (payroll expense transfers).

UC Path Direct Retro Processing Schedule

https://www.centralresourceunit.ucla.edu/s/article/Direct-Retro-Processing-Schedule-2021-2022

Non-Payroll Expenditure Adjustment Request (NPEAR)

Non-payroll expenditure adjustment requests (NPEARs) transfer non-payroll costs. They should only be used to correct non-payroll expenses charged to an incorrect funding source and should not be used as a tool for managing funds.

If you identify a non-payroll expense charged to an incorrect funding source (e.g., when reviewing your monthly reports), fill out the Cost Transfer Justification form and send a copy signed by the PI to your fund manager so that they may move the expense to the correct funding source.

To ensure your NPEAR was processed correctly, please check your monthly reports to make sure that the expense was moved to the correct funding source.

Cost Transfer Justification Form

The cost transfer justification form is located here.

Below is a list of the questions that must be answered prior to a cost transfer being processed, along with examples of acceptable responses. Example responses should not be copied and pasted and should be tailored to your specific request.

Question 1: How did the error occur and why is the transfer being requested?

- Expense was appropriately charged to the project; however, it exceeds the approved budget for this expense category

- The individual was working on this project but his/her time was reassigned upon receipt of a new award

- Error was a clerical one (transposition of numbers)

- PI re-evaluated how an item was used once it was purchased

- Transfer being made to accurately reflect effort devoted to the project

Question 2: Who approved the transfer of funds?

- PI

Question 3: How does the transfer benefit or impact the new funding source being charged?

- Payroll will accurately reflect effort on the project

Question 4: Explain delay if transfer is >120 days after the original transaction date and/or >90 days after the fund end date.

- PI recently communicated effort adjustments on projects

- Late execution of award

- No cost time extension approval delay by sponsor

Common Mistakes

- Stating that the administrator or fund manager approves the transfer

- Cost is transferred to a project fund to use up the remaining balance for a fund that is ending as a cost management strategy

- Cost is transferred to a project fund to avoid or eliminate cost overrun on another sponsored project fund

- Cost of other PI’s project is transferred to my project fund to financially support important research of my colleague

- To eliminate cost overruns

- To spend down unused funds

- For reasons of convenience

- For reasons that do not comply with sponsor regulations or award guidelines

- Shortage of staff. This indicates lack of internal controls overall; who was managing a sponsored fund during this period?

Research Participant Payment Requests

When research projects include payments to study participants, you will need to submit a research payment request after the study has received IRB approval, if applicable. Research payments can be made in the form of gift cards or cash as described below.

Types of Disbursements

Semel uses the campus-approved disbursement types described below. Requests are limited to $2,500 (exceptions will be considered with appropriate justification).

- Gift Cards (physical or via e-code)/Tremendous (only via e-codes and participant contact information must be available at time of request)

- Please review the Gift Card Catalog to determine the gift card or e-code vendor. The catalog has information on each vendor type, including associated fees, available denominations, and processing times. Refund policies and instructions (if available) for each vendor type are also available on the catalog

- Tremendous is a gift card option for Research Payment Disbursement Requests that offers a wide variety electronic gift cards (e-codes). Participants may select their preferred vendor and receive the e-code directly. Please review the Tremendous Gift Card Department Manual and Demo Link for detailed information, recipient instructions, and FAQs. The Tremendous Gift Card Recipient Manual may also be shared with the participant for quick redemption instructions.

To submit a request you will need to submit one of the following forms. If you are requesting research payments, you will need to submit the IRB-approved Gift Card form. If you are requesting payment for non-research activity, you will need to submit the Non-IRB Gift Card form.

IRB approved Gift Card form: https://ucla.app.box.com/v/psc-human-subject-gift-card

Non-IRB Gift Card form: https://ucla.app.box.com/s/z438fkqakmgv6tcmhk2m3sp4v4ri6o2f

- Cash

- Delivery for cash will be made within ten (10) business days and will only be released to the Authorized Personnel identified on the form. This estimated fulfillment time assumes all required forms have been accurately submitted to SFS. Timely fulfillment is dependent on the department’s participation and accuracy in completing the required steps.

To submit a request you will need to submit one of the following forms. If you are requesting research payments, you will need to submit the IRB approved Cash form. If you are requesting payment for non-research activity, you will need to submit the Non-IRB Cash form.

Cash IRB-approved form: https://ucla.app.box.com/v/psc-human-subject-cash

Cash Non-IRB form: https://ucla.app.box.com/s/krq43glpw93aghhil4ohfodd4ir9nizi

In order to initiate a research payment request:

- Complete the appropriate form and forward to your fund manager, along with the department required attachments listed below.

- A current IRB. If the IRB will be expiring within two months, you must indicate that you are working on the continuing renewal. If it is expiring within one month, you must wait until you have a new IRB approval and consent form.

- Study consent forms. Consent forms must include the Protocol ID line on the bottom and the amount of payment for participation.

- A Human Subject Replenishment Spreadsheet that shows how each disbursement has been paid out. You’ll need to keep track of this even if you do not make another disbursement request. Note this spreadsheet is not needed the first time you make a human subject disbursement request.

- The form will be reviewed and signed by the Fund Manager who will then forward to the Cash Manager (Gladys Carrera).

- Gladys will review and upload all required forms to Payment Solutions and Compliance.

- Payment Solutions & Compliance will review and e-mail the requestor to schedule delivery of gift cards/cash.

- Brinks will deliver gift cards/cash.

Tips for completing the human subject disbursement request:

- IRB: You must have a current IRB prior to submitting any requests

- Department Name & Code: Semel NPI (2000)

- Delivery Address: This is the address where the cash or physical gift cards will be delivered by Brinks

- Authorized Personnel: If possible, include two authorized personnel, since Brinks will only deliver to the personnel named on the form. (Bruincard ID # is the Employee Number)

- Disbursement Type: You can only choose one type per request. For Cash, you must indicate the denominations. Cash requests should be delivered within 10 business days.

- General Ledger Account charges and recharges: There are two charges, 1) the Gift Cards or Cash, and 2) the Brinks delivery charge. You may use different FAUs. The on and off campus Brinks charge is $19.50 (does not apply to E-Codes).

- Safe Type: You must include the safe type and Serial Number. The following is the Payment Solution & Compliance current requirement (does not apply to E-Codes):

- $0-$1,000 Lock Box

- $1,001-$2,500 Safe

- $2,501-$25,000 Steel-Door safe

- $25,001-$250,000 TL-15 Composite safe or better

- Over $250,000 TL-30 Steel or better

Deviation from these procedures may jeopardize the University’s liability coverage.

IRS Requirement: If any research participants receive more than $600 in a calendar year, review the following link: https://www.finance.ucla.edu/tax-records/tax-services/form-1099-misc-miscellaneous-income-form. All participants who meet this $600 threshold will need to be issued a 1099 tax form.

Payment Solutions and Compliance

1125 Murphy Hall

Mail Code: 708901

Phone number: 310-794-5333

Office Hours: Monday – Friday, 10am to 2pm

What is Effort Reporting?

Effort is defined as the amount of time spent on a particular activity. This includes the time spent working on a sponsored project in which salary is directly charged or contributed/cost-shared.

Effort reporting is the method of certifying to the granting agencies that the effort required as a condition of the award has actually been completed. Effort reports pertain to any funds that are Federally sponsored (certain LA County contracts may require certification as well) that PIs and staff are paid from.

Why is Effort Reporting required?

Federal regulations require that any individual committing effort on a federal or federal flow-through contract or grant certify that the salary charged or cost shared by the institution is reasonable in relation to the effort expended on that project. Uniform Guidance 2 CFR 220.430 – Compensation-Personnel Services (formerly OMB Circular A-21) sets the criteria for acceptable methods of charging salaries and wages to federally sponsored projects, and requires that institutions follow acceptable methods for documenting the distribution of effort for all project personnel. See “Standards for Documentation of Personnel Expenses” in the provided link for more information on the Uniform Guidance.

The Effort Reporting System (ERS) is the interface that UCLA has chosen for documenting its distribution of effort on federal projects and staying compliant with 2 CFR 220.430. Mandatory certification of effort by principal investigators and staff in the ERS system is therefore a matter of federal compliance for UCLA.

Who is allowed to certify an Effort Report?

This is an often overlooked question, and it is important to note the following:

- Principal Investigators/faculty are required to self-certify their own effort reports (even on Cost Centers belonging to another PI)

- Staff can certify their own effort reports or the PIs can certify for them on lines pertaining to their own Cost Centers

- Certifiers must have first-hand knowledge of the work performed

What if a PI terminates his/her appointment before certifying his/her staff’s effort reports?

- If the PI is still affiliated with UCLA and has access to the ERS system, please have them log on to the system and certify their reports.

- If the PI no longer has access to ERS, you may send them a copy of the effort report requiring certification and have them reply with their certification. To do so, you may either use the “Send” function in the system (navigate to the desired report and click the “Send” button on the top right hand) or take a screenshot of the report and paste it in an email to them; please see more specific instructions using the latter method below

- If the PI is no longer reachable and option 1 and 2 above are not feasible, then the last option is to have someone with first-hand knowledge of the project and the effort worked to certify the effort reports. The individual certifying the report on behalf of the PI should provide an explanation in the “Comments” field, indicating that the PI is unavailable and that the person certifying on his behalf has first-hand knowledge of the PI’s or employee’s effort.

Certification by Email Instructions (Option 2 Above)

- Send an email to the PI/Employee with screenshots of each of their effort reports, asking that they certify via email and provide permission for the center to certify on their behalf. In their response, they should verify/confirm the effort in the attached report is correct, or state what the correct effort should be, if any changes are required. Retain a copy of the email certification for your center’s records.

- Reach out to EFM ERS Help (ershelp@research.ucla.edu) and ask that they give access to your center director to certify on behalf of the PI/Employee as they are unavailable.

- Once access is granted, the center director can view/certify the PI/Employee’s reports by subscribing to the applicable PI’s effort reports in the ERS System (see steps/screenshots below).

- While certifying the center director would also include a comment for each report, stating something along the lines of “Certifying on behalf of employee as Center Director, with employee certification via separate correspondence.”

- Once certification is complete, reach back out to EFM ERS Help and ask that the Center Director’s additional access rights be removed.

Subscribing to a PI’s Reports

- Go to “Manage Searches”

- On the bottom of the page, click “Subscribe”

- At the top of the resulting pop-up window, search the PI by last name, UID or department code

- Subscribe to both “My Projects” and “My Certifications”

- Close the pop-up window and wait 10-15 seconds for the page to update which will populate with the PI’s “My Projects” and “My Certifications” lists for certification.

Where can I go to begin certifying my reports?

Certifiers already familiar with the certification process outlined in the next section may log into the ERS system at ers.it.ucla.edu/EffortReporting/ using their UCLA Logon (BOL) to begin certifying.

I am off-campus and can’t access the ERS System

If accessing the ERS System from off-campus a Virtual Private Network (VPN) will need to be used. For more information on downloading/setting up a VPN on your machine, please see Bruin OnLine.

Certification Guide

When logged in to the ERS system the following should be displayed on the screen (if not, please adjust accordingly):

1. Display Saved Search: My Certifications AND My Projects (check both)

2. Show Status: ALL-Open

3. Reporting Periods: ALL

At this point, there will be a listing of all effort reports remaining for your certification (some reports may require payroll adjustment before certifying). Per the above, both the “My Certfications” and “My Projects” tabs should be monitored (under the “Display Saved Search” dropdown) to view all outstanding reports. Click on the first line to begin review and certification.

When ready to certify, at the bottom of each report click the “CERTIFY EFFORT REPORT” button. The system will automatically take you to the next ERS report that needs to be certified.

For Multiple Certifications by several PIs, please click on the check box and manually move to the next ERS report.

What if I have unfunded effort (cost sharing) on a federal project?

If you reported unfunded effort to a federal agency via RPPR it will not be automatically included in your effort report. Instead this effort needs to be manually added to your report following the steps and accompanying snapshot below:

- If you can already see the fund on which you have unfunded effort in your report:

- Enter the unfunded effort % in Column D: “Cost Share Effort % to Certify”

- Subtract said effort % from your Non-Sponsored Activities (also in Column D)

- Enter a comment as to the purpose of the adjustment being made and click the save button

- If you cannot see the fund on which you have unfunded effort in your report:

- Click the “ADD ADDITIONAL SPONSORED PROJECT” button and select the unfunded effort project FAU that is missing from your report

- On this new line, enter the unfunded effort % in Column D: “Cost Share Effort % to Certify”

- Subtract said effort % from your Non-Sponsored Activities (also in Column D)

- Enter a comment as to the purpose of the adjustment being made and click the save button

Additional Resources

For further reading and guidance on effort reporting and the ERS System, the below provided summary/guide may be of interest:

The above information is being sourced from EFM ERS Support whose training materials and guidance are another great resource for further information.

Have Further ERS Questions?

Most effort reporting questions regarding payroll/effort distribution and using the ERS system are best answered by a PI’s assigned research administrator and, in some cases, their fund manager. To see your specific assignments, see:

For questions regarding reports on Exception or Certified/Adjustment Required status (but not under preliminary review), please contact:

If you have an ERS system access request, or reason to believe that some of your reports should not be on preliminary review, please contact:

What is a Prior Approval Request?

Prior approval is the process in which a grantee must obtain written approval from an authorized official before undertaking an activity that has the potential to impact a project’s scope. To initiate the process complete the Prior Approval Request form.

Types of Prior Approval Requests

There are four types of prior approval requests that are supported via eRA Commons:

(1) No Cost Extension Requests (NCE)

Request for an extension of time to a project period and/or budget period to complete the work of the grant under that period, without additional sponsor funds.

NIH First NCE Request:

For the first NCE, we recommend submitting the request (Prior Approval Request form) to your assigned fund manager at least one month prior to the project end date. S/he will then submit to OCGA for submission to NIH. On the form, provide a brief explanation for the requested extension. Most first NCE requests grant an additional 12 month extension.

NIH will typically approve the first NCE within days of the request being received.

If the NCE request is not submitted to NIH in advance of the project end date, you will need to follow the steps outlined below in order to request the extension.

Additional NCE Requests:

Any request beyond the first NCE will require additional documentation and information. We recommend submitting these requests at least one month prior to the project end date.

You will need to submit the following to your assigned fund manager for review and submission to OCGA:

- Cover Letter addressed to the Grants Management Specialist (GMS) stating your request and providing a brief justification for the extension. This should be signed by the PI and OCGA authorized official.

- Budget, PHS 2590 Form Page 2

- Budget Justification

- Progress Report

- Checklist, PHS 2590 Form Page 6

- Prior Approval Request form

- Edge Tracking form

Please note, NCE requests beyond the first are more difficult to justify and obtain. The feasibility of such requests being approved should be discussed with your Program Officer (PO) and GMS several months before the project end date.

(2) Request for withdrawal of an application

A PI or authorized official may initiate the request to withdraw and application from consideration of award, but only the authorized official can submit this request.

(3) Carryover

Request to carry a balance remaining at the end of a budget period into a later budget period. This requires an explanation of unobligated funds, budget, budget justification and scientific justification for the request. Only an authorized official can submit this type of request and this type of request is only necessary for awards that are not Streamlined Non-Competing Award Process (SNAP) eligible.

(4) Request for Change of PD/PI

Biosketches and Other Support documents are required when adding a new PI. Only an authorized official can initiate and submit this type of request.

Other Types

Other types of prior approval requests that may be necessary but cannot be submitted via eRA Commons include:

Reduction in PI/Key Personnel

If a key person must reduce their time by more than 25% of what they committed to, a request must be made in advance of the change, which provides the rationale for the change and how the project’s scope is impacted. The request letter must be signed by the PI and authorized official and submitted to the PO and GMO.

Rebudgeting Over 25%

If funds need to be rebudgeted across budget categories by more than 25% of the total costs of an award, a prior approval request must be submitted. The request letter must be signed by the PI and authorized official and submitted to the PO and GMO.

Guidelines

NIH Statement of appointment form (2271 form) must be signed by Grace De Jesus before submitting to Academic Trainee Office. Please review NIH websites in regards to statement of appointment, amendments, and X-Train: XTrain Quick Reference Guide

Time Commitment

Trainees are required to devote full-time effort to the training program however, they may receive additional supplement salary:

NIH recognizes that trainees as students may seek part-time employment coincidental to their training program to further offset their expenses. Funds characterized as compensation may be paid to trainees only when there is an employer-employee relationship, the payments are for services rendered, and the situation otherwise meets the conditions of the compensation of students. In addition, compensation must be in accordance with organizational policies consistently applied to both federally and non-federally supported activities and must be supported by acceptable accounting records that reflect the employer-employee relationship. Under these conditions, the funds provided as compensation (salary, fringe benefits, and/or tuition remission) for services rendered, such as teaching or laboratory assistance, are not considered stipend supplementation; they are allowable charges to Federal grants, including PHS research grants.

However, it is expected that compensation from research grants will be for limited part-time employment apart from the normal full-time training activities. Part-time is considered by NIH as up to 20 hours per week. Compensation may not be paid from a research grant that supports the same research that is part of the trainee’s planned training experience. Under no circumstances may the employment interfere with, detract from, or prolong the trainee’s approved NRSA training program.

Funds may be rebudgeted only as follows: 1) Trainee-related expenses: Rebudgeting of funds awarded in a lump sum for trainee-related expenses does not require NIH awarding office prior approval. 2) Trainee costs: For rebudgeting purposes, trainee costs include funds awarded in the stipends or tuition/fees and health insurance budget categories. These costs may not be used for other purposes except under unusual circumstances and then only with the prior approval of NIH awarding office.

Unless otherwise restricted, rebudgeting into or within the stipends and tuition, fees, and health insurance categories is allowable without prior approval of the NIH awarding office. 3) Trainee travel: For rebudgeting purposes, trainee travel is not considered a trainee cost and, therefore, may be rebudgeted into any other budget category without prior approval of the NIH awarding office.

Set-Up and Adjustments

Use account #431587 for training related expenses (benefits, supplies, travel & administrative salary) and account 781587 only for Stipends and Tuition/fees.

You must identify an Unrestricted FAU which will cover any unallowable expenses, such as Life Insurance, Worker’s Comp, and Disability. FAU should be a funding source from the mentor. The FAU will also be charged if the grant does not cover the cost of regular benefits.

To make adjustment to the appointment, obtain approval from Grace de Jesus on the adjustment form. Once approved, submit the form to the Academic Trainee Office.

Close-Out

Before submission of Termination Notices to NIH via X-Train, the administrator should prepare a hard copy to be reviewed and submitted to OES office (Grace de Jesus). They will run a Stipend summary worksheet to ensure the dates of training and that the total stipends paid matches the Campus General Ledger. The total stipend on the Termination Notice and Campus General Ledger should match before EFM submits to NIH.

Information & instructions for completing a Termination Notice: Instructions for Completing a Termination Notice.

Submitting an NIH Research Performance Progress Report (RPPR)

The NIH Progress report is known as the Research Performance Progress Report (RPPR) and is typically due 45 days before the end of the budget period for SNAP-eligible awards and 60 days before the end of the budget period for non-SNAP awards. The report updates NIH on the scientific and financial progress of an award.

- The Admin/PI should send an e-mail to their fund manager and cc Christine Lavoie with subject line “PI Last Name, Fund #, DUE DATE” at least 2 weeks in advance of the due date.

- Christine will check if the award is under Streamlined Noncompeting Award Procedures (SNAP), which allows the PI to submit directly through the Commons. If the award is not subject to SNAP, it must be routed to the authorized official.

- As soon as the RPPR is ready, send a pdf along with the eDGE tracking form to the fund manager and Christine – no later than 3 business days prior to the due date.

- The fund manager will review the participant section to check that effort was reported correctly and any budget-related questions, i.e., unobligated balance and funds sent to foreign sites.

- Christine will review non-budget sections, incorporate fund manager feedback and provide feedback within 2 business days of receipt.

- Once the RPPR has been finalized, a pdf should be sent to Christine and the fund manager. Christine will then forward the eDGE form to Proposal Intake and notify them that the RPPR is: 1) being submitted by the PI (for SNAP) OR 2) routed to them for submission (for non-SNAP).

For interim RPPRs, complete the eDGE tracking form. And if needed, see detailed instructions on completing an RPPR.

There are three types of RPPRs:

- Annual RPPR– Use to describe a grant’s scientific progress, identify significant changes, report on personnel, and describe plans for the subsequent budget period or year.

- Final RPPR– Use as part of the grant closeout process to submit project outcomes in addition to the information submitted on the annual RPPR, except budget and plans for the upcoming year.

- Interim RPPR– Use when submitting a renewal (Type 2) application. If the Type 2 is not funded, the Interim RPPR will serve as the Final RPPR for the project. If the Type 2 is funded, the Interim RPPR will serve as the annual RPPR for the final year of the previous competitive segment. The data elements collected on the Interim RPPR are the same as for the Final RPPR, including project outcomes.

OCGA Instructions on Other Support:

https://ocga.research.ucla.edu/other-support/

Non-NIH Progress Reports

For non-NIH sponsors, please review the terms and conditions listed on your award notice to determine the due dates for technical/narrative and financial reports. If reports require review by central offices, please submit to your OES fund manager 5 days before the sponsor deadline to allow sufficient time for review.

Narrative reports that do NOT contain financial information and are purely scientific can be prepared and submitted directly by the PI with your signing official cc’d.

Narrative reports that DO contain financial information must be prepared by the PI/administrator together with your assigned OES fund manager. Your fund manager will then forward to the assigned EFM accountant for review. Once EFM approves of the financial information included in the report, the PI may submit the report directly to the sponsor, with your signing official and EFM accountant cc’d.

Financial reports reports must be prepared by the PI/administrator together with your assigned OES fund manager. Your fund manager will then forward to the assigned EFM accountant for review. Once EFM approves of the financial information included in the report, the assigned EFM accountant will submit the report directly to the sponsor OR approve of the PI submitting, with the EFM accountant cc’d.